Contact Us: 250-258-9888 | contact@kelownarealestatepros.com

Kelowna Real Estate Listings | View All

You may be shocked to see your most recent property assessment. It is likely that the official assessed value of your home will have gone up between 17-42%, depending on your property type and location. This large increase is inline with the increase in home sale pricing that we saw throughout 2021 and brings property assessments more on par to today’s market.

Kelowna’s 2022 typical assessed value is $869,000, a 34% increase from $650,000 in 2021. In West Kelowna, the typical assessed value in 2022 is $856,000, up 34% from $632,000 in 2021. Lake Country saw a 32% increase with a typical assessed value of $886,000 from $672,000 in 2021 (source - Global News)

Kelowna Real Estate Market Stats - 2021

To understand the jump, let's look at how the market rose in Kelowna in 2021, in each main property type category.

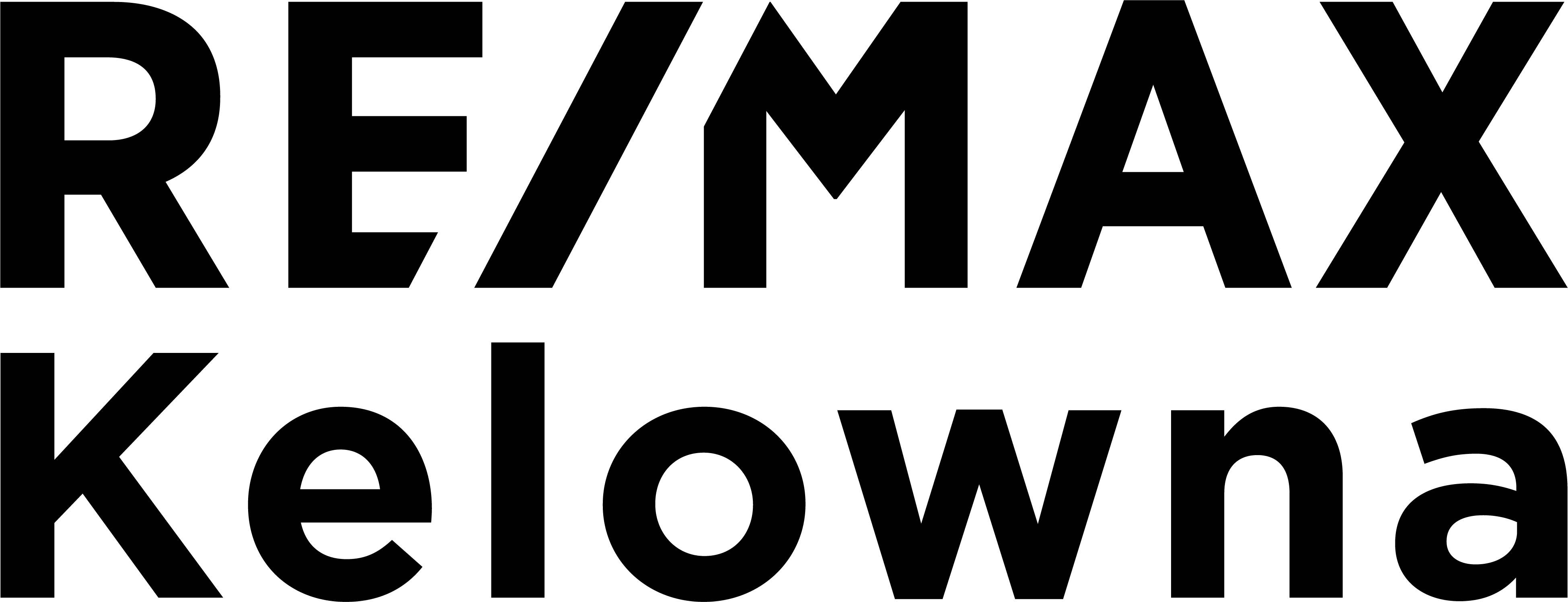

Average Sale Pricing for Condos:

January 2021 - $375,846

December 2021 - $509,335

Highest average sale price occurred in December 2021 - $509,335

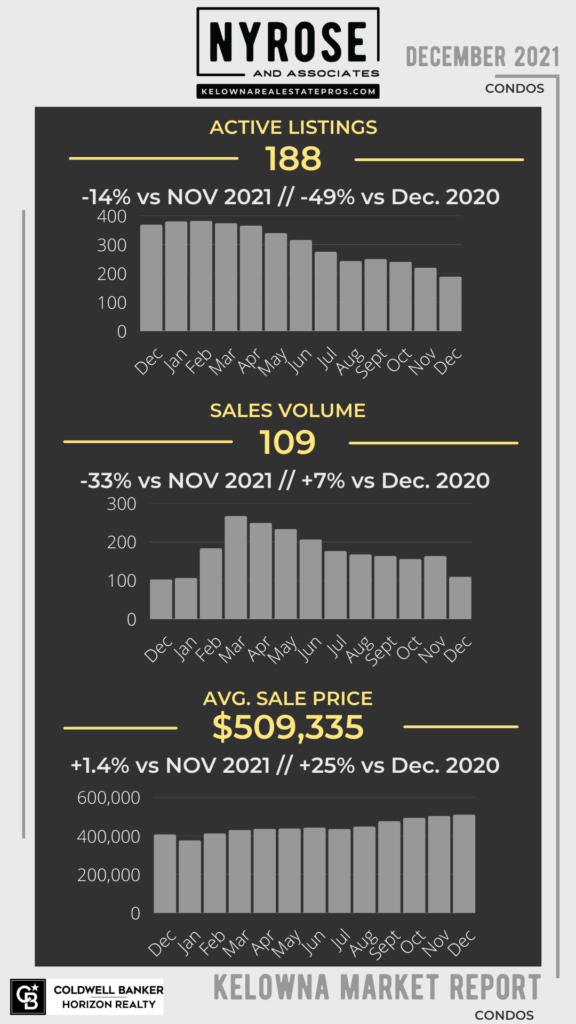

Average Sale Pricing for Townhomes:

January 2021 - $593,398

December 2021 - $697,817

Highest average sale price occurred in December 2021 - $697,817

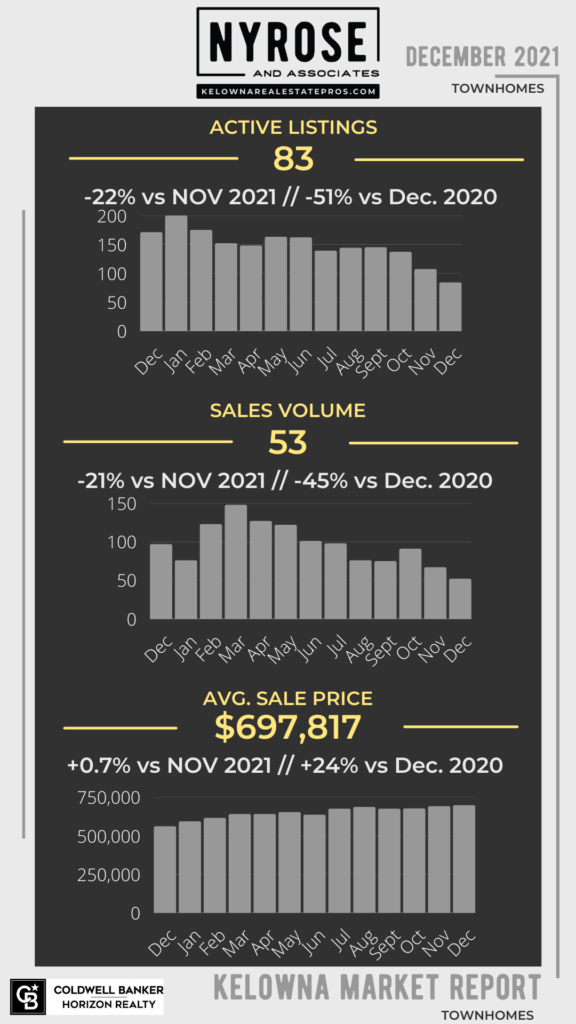

Average Sale Pricing for Single Family Homes:

January 2021 - $936,013

December 2021 - 1,040,708

Highest average sale price occurred in October 2021 - 1,153,564

What is the Significance of a Property Assessment?

Property assessments are used for taxation purposes, and are not necessarily typical of what your home might be worth in today’s market. You can look up your property assessment value HERE, and if you see a similarly high increase, you can expect that to translate into a higher property tax bill.

But, is your assessed value really what your home is worth?

The property assessment of a home is just one factor a professional, experienced REALTOR(r) will look at when determining the fair market value of your home, and isn’t necessarily the best indicator when pricing a home for sale.

“The answer to what your home is worth is what a buyer is willing to pay for a home and what a seller is willing to sell the home for” - Darcy Nyrose

In order to determine what today’s buyer might pay for your home, we have to see inside and assess your home’s features. We then compare your home to other similar homes on the market, and past sales. In addition, we analyze the current buyer demand for a home like yours as well.

“We work with you to create a selling strategy that is designed to help you make the most out of today’s market, while meeting your real estate goals.” - Darcy Nyrose

Is your home likely to create a frenzy among today’s buyers and incite multiple offers? Do you have the patience to push on price and timelines? Or, are you looking for a quick sale? Together, we can answer these questions and determine the right list price, that may (or may not) be inline with your most recent home assessment.

If you’re curious about the true fair market value of your home in today’s market, we’d love to chat and set up a no-obligation free market evaluation.

Contact Nyrose & Associates

250-258-9888

contact@kelownarealestatepros.com