Contact Us: 250-258-9888 | contact@kelownarealestatepros.com

Kelowna Real Estate Listings | View All

August 1, 2023

On July 12, 2023, the Bank of Canada announced another interest rate hike, right on the heels of one in June. Leading to this announcement, many were speculating if rates would hold, continue to raise, or even go down.

With the possibility of another rate hold or hike in September, buyers and homeowners are urged to focus on what they can control: locking in the best rate they can for their financial situation and shopping in a price range where the monthly payment fits their budget.

As Darcy notes in his market recap below, whenever there are outside forces impacting the real estate market, activity might pause or slow down for a bit while everyone waits to see if the sky will fall, but then things go back to a more normal activity level, sometimes with a few adjustments.

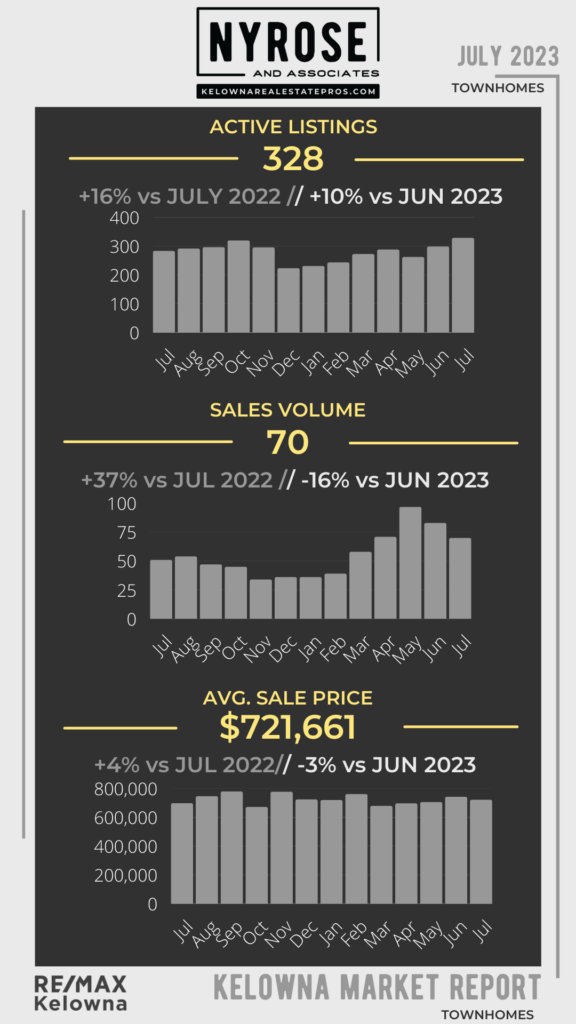

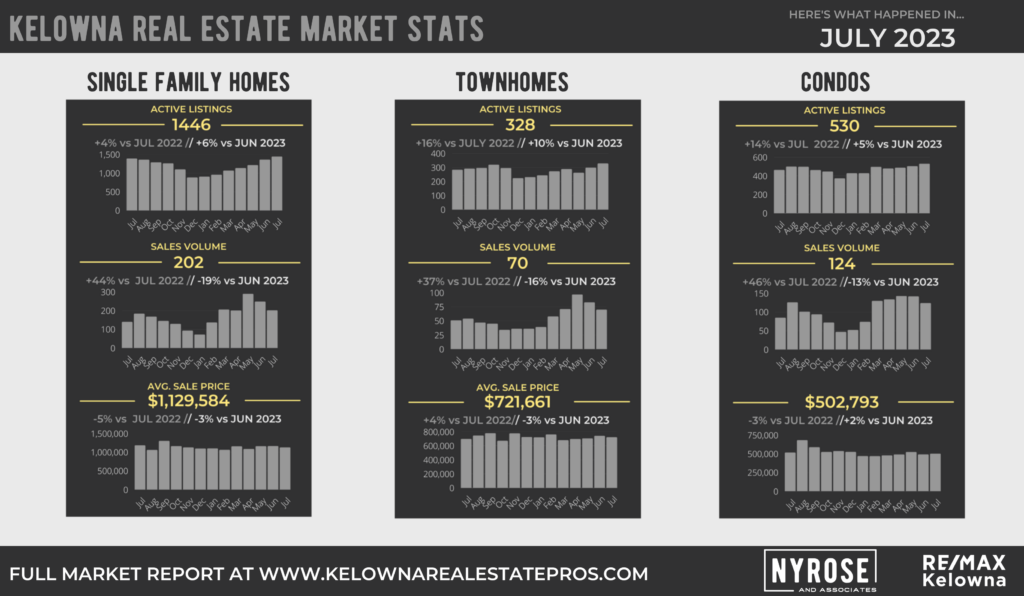

Inventory is up over last month and last year; however sales are down (16%) over last month but up 37% over last year. Pricing has been pretty steady all year.

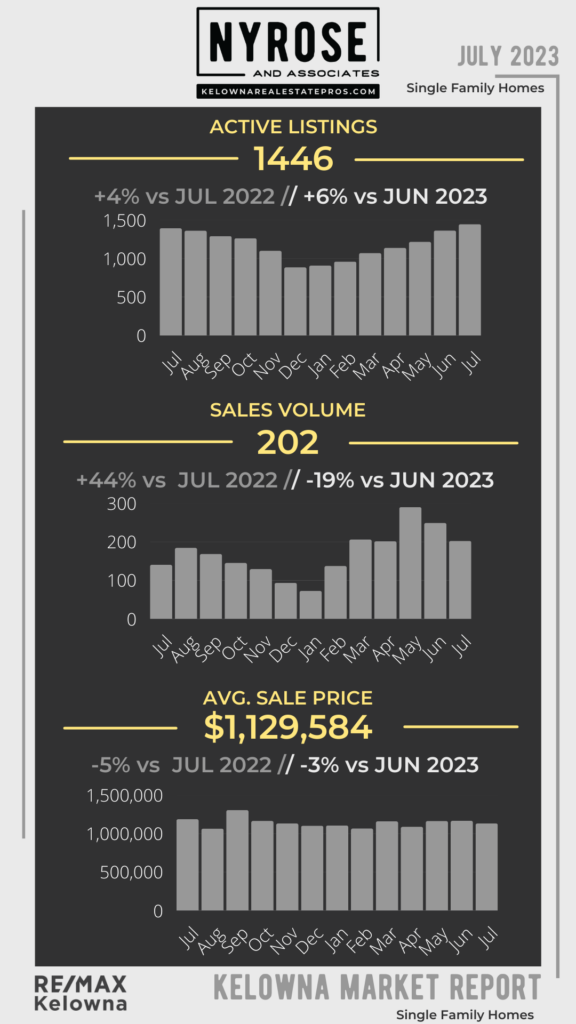

We're seeing more single family homes hit the market, after a bit of a low-inventory lull in the winter. Sales are down 19% over last month but up 44% over last year. The average price of a single family home remains over $1-million and sits at a healthy $1,129,584 (down 3% over last month and down 5% over last year).

If you're looking to buy or sell Kelowna real estate, contact Nyrose & Associates today!